Your Council Tax bill

Descriptions.

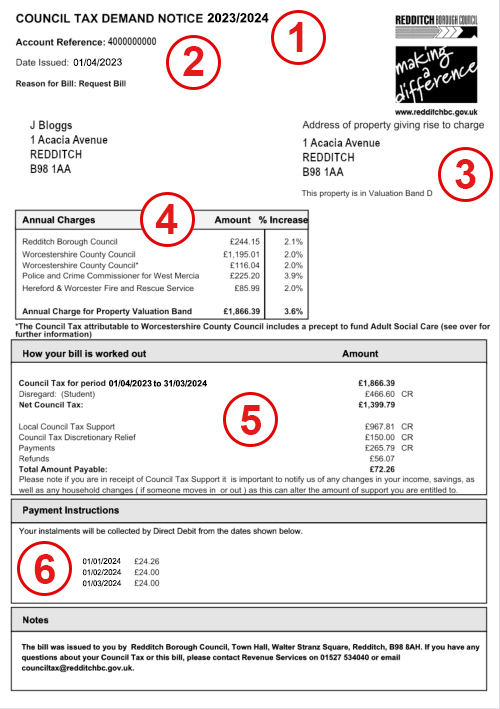

- Your annual bill is called the 'Council Tax demand notice 2023/2024'. This is the legal name for a council tax bill in the UK.

- The 'Account Reference' for your household's Council Tax number that begins with a “4”. You must use this reference number when managing your Council Tax online, when making a payment, or when you have any Council Tax query.

- This is which valuation band your property has been given. A valuation band is a range of property values, represented by a letter from A to H. The higher the letter, the higher the estimated value of your property compared with other properties. Your property valuation band is decided by the UK Valuation Office Agency (VOA).

- This is the total amount of Council Tax you must pay each year. It also shows how much goes to different organisations' services. For more information please refer to the information that accompanied your bill or press here to read how your council tax is spent.

- Under the heading “How your bill is worked out” you will see the gross amount that you must pay for the whole year, before any discounts, exemptions or premiums have been applied. If you have claimed a discount or exemption, then this will be shown and will either reduce or increase the total bill. Recipients of the Local Council Tax Reduction Scheme (or LCTRS, formerly known as Council Tax Benefit) will see the amount that they have been awarded. The Total Amount Payable is the net amount due for the year. This sum may change during the year due to changes in qualification for discounts and LCTRS. Press here for more information on discounts and exemptions.

- You can choose to pay all your council tax in a single payment, but most people pay a smaller amount each month. Your bill will tell you when your first instalment – your first monthly payment – is due, and how much you must pay. It will also tell you how much you must pay each month for the rest of the year up to March 2024. The first instalment is usually different to the amounts for the rest of the year. This is because the total bill for the year usually doesn't divide exactly by the number of months, so we include the difference in the first month.

Feedback & Share

Share this page on social media